Consider Alcatel-Lucent’s project in Problem 6.

a. What is the free cash flow to equity for this project?

b. What is its NPV computed using the FTE method? How does it compare with the NPV based on the WACC method?

Problem 6

Suppose Alcatel-Lucent has an equity cost of capital of 9.4%, market capitalization of $9.49 billion, and an enterprise value of $13 billion. Suppose Alcatel-Lucent’s debt cost of capital is 7.1% and its marginal tax rate is 35%.

a. What is Alcatel-Lucent’s WACC?

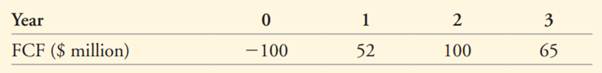

b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the following expected free cash flows?

c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)?