1. Cost of employee pay and benefits

D’Artagnan launches a personal bodyguard service at the start of x1. The company’s name is ‘Les

Mousquetaires’. Its financial year ends on 31 December. The following three parts deal with payroll

issues the company faces during the year. Assume each part is independent. All amounts are in euros.

Part A

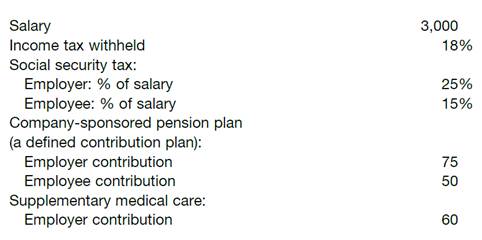

‘Les Mousquetaires’ hires three employees: Athos, Porthos and Aramis. Set out below are the

monthly pay, tax and benefits data for each of the three men in x1.

Required

Calculate the monthly salary expense and employee benefits expense of ‘Les Mousquetaires’ in x1. What is the net pay Athos, Porthos and Aramis receive in a typical month?

Part B

The salary Athos, Porthos and Aramis receive each month is based on the number of days worked. Assuming a month of 20 working days, this amounts to ![]() 150/day. ‘Les Mousquetaires’ grants them two paid days of holiday for each month (20 working days) of service. Unused days can be carried forward indefinitely and are paid off when employment ends. In x1, the three each earn 24 days’ paid holiday over the year. By the end of the year, each has used 20 days (Porthos to visit relatives in Brittany, Aramis a ‘cousin’ in Tours, and Athos – well, that’s a mystery).

150/day. ‘Les Mousquetaires’ grants them two paid days of holiday for each month (20 working days) of service. Unused days can be carried forward indefinitely and are paid off when employment ends. In x1, the three each earn 24 days’ paid holiday over the year. By the end of the year, each has used 20 days (Porthos to visit relatives in Brittany, Aramis a ‘cousin’ in Tours, and Athos – well, that’s a mystery).

Required

Calculate the cost to ‘Les Mousquetaires’ of holiday pay earned during x1. What is the ‘accrued holiday pay’ liability at 31/12/x1? Ignore income tax and benefits.

Part C

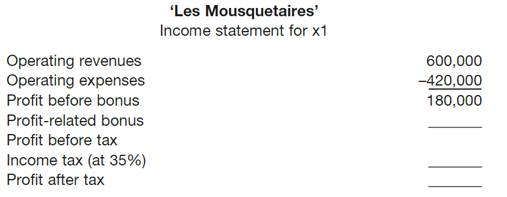

‘Les Mousquetaires’ has a busy and successful first year. D’Artagnan decides the company will distribute a bonus to the three employees which will amount in total to 10% of its x1 after-tax profits. The corporate income tax rate is 35%. The bonus is tax-deductible.

Required

Complete the summary income statement for x1 set out below. What is the gross amount of bonus Athos, Porthos and Aramis will each receive?

Check figure:

Part C Income tax 59,155